Loans

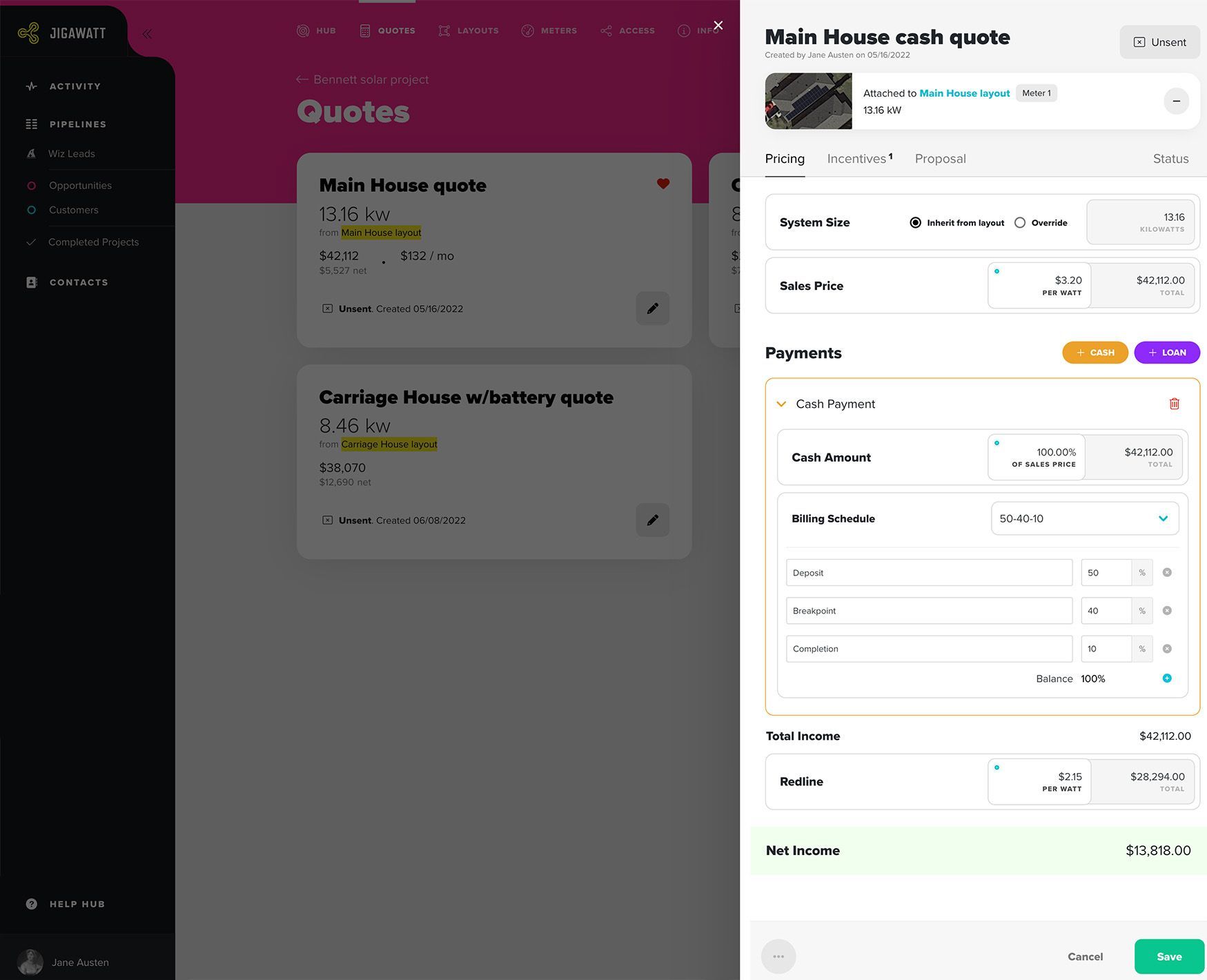

When building out a Quote, once you've figured out how much the system will cost, you'll determine how the customer will be paying for it. You can chalk up cash payments, loans, or both at the same time! You can take cash in four installments, a token down payment with the bulk of the amount financed, or split the whole nut between three different lenders if you want. It's a free country! Jigawatt Fusion's payment methods are very flexible to accommodate whatever bizarre scheme your customer throws at you (assuming you're willing to accommodate them, of course).

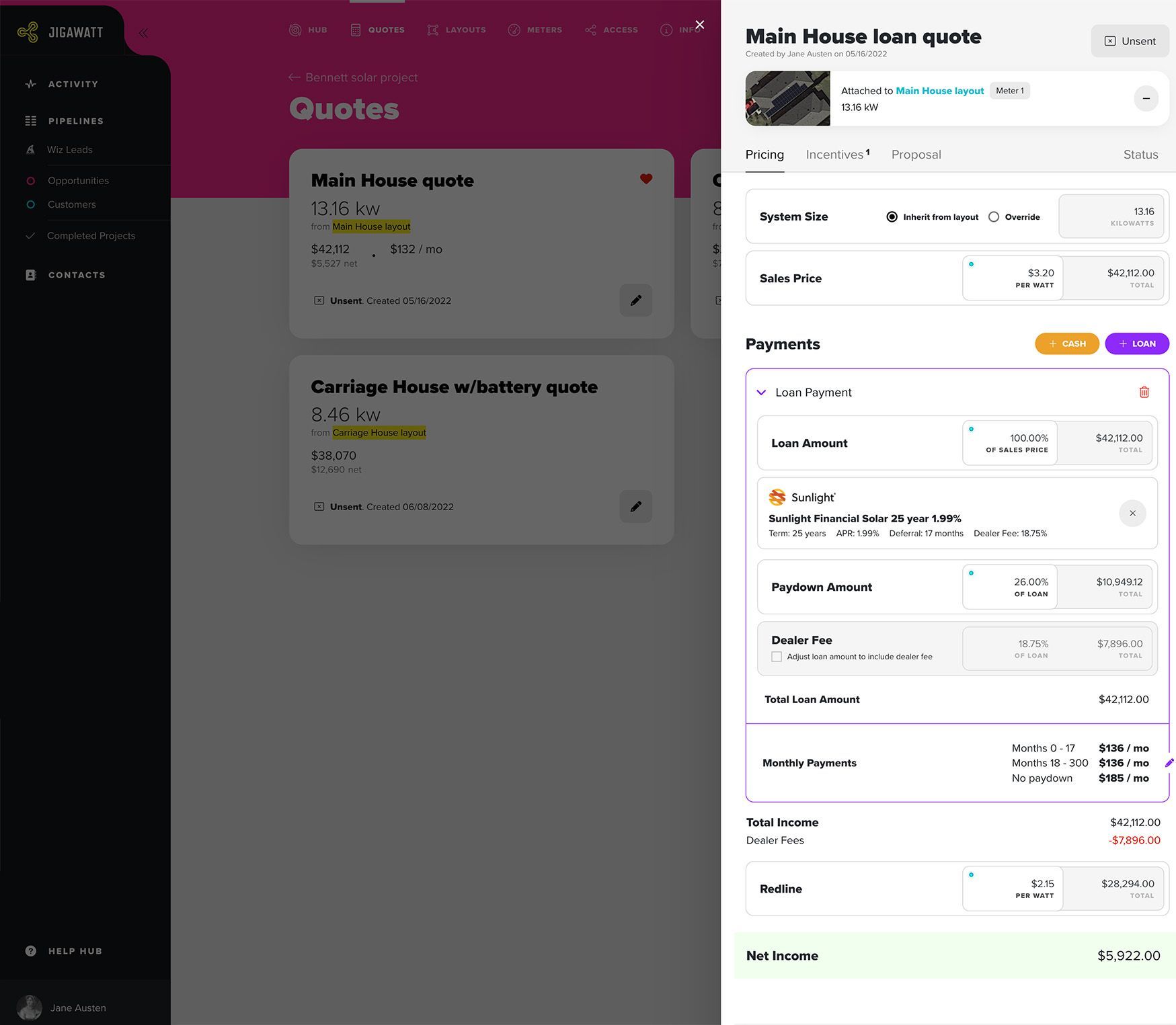

Most of the time, however, your payment methods will be pretty straightforward. To add a loan:

Click Add Loan Payment. Decide how much of the Sales Price you want to finance. Most of the time, it will be 100%.

Choose the lender, followed by the specific loan product. Bear in mind that your choices are limited to loans that have already been enabled in your Loan Library by a user with access to Workflow Settings. So if the options look a little sparse, it's your coworker's fault!

Adjust the paydown if your customer plans on paying something other than the default amount of the U.S. Solar Investment Tax Credit.

You can optionally wrap up the dealer fee in the loan amount simply by clicking a checkbox.

Monthly payments are calculated under several different scenarios, including the possibility that the customer spends their tax credit on jet skis instead of paying down their solar loan (just set the paydown to $0 to see what their payment will look like if they do something irresponsible).

Integrated vs. Internal loan calculators

Every solar lender seems to have something slightly unique about the loans they offer. Even though they've got pretty much all the same rates, terms, and payment structures, something has to help all those MBAs at corporate feel like they're doing a good job, so there are subtle–if meaningless–differences between one lender's 25 year, 2.49% loan and another's. These "proprietary nuances" are nearly impossible to reverse engineer, and as a result, many of the loans in the Jigawatt Fusion loan library are close estimates; the payments calculated might a couple dollars off from the lenders' calculations.

In some cases, Jigawatt Fusion has integrated with the lenders' calculators, so the payments quoted are exact. In others, we've made a fairly convincing knock-off. The Jigawatt Fusion development team is constantly trying to coordinate with lenders to integrate the calculators to improve your experience. If your fave lender hasn't integrated with us yet, pester them to do so!

For a more comprehensive rundown on setting up your Integrated Lenders, check out this article on the Loan Library.

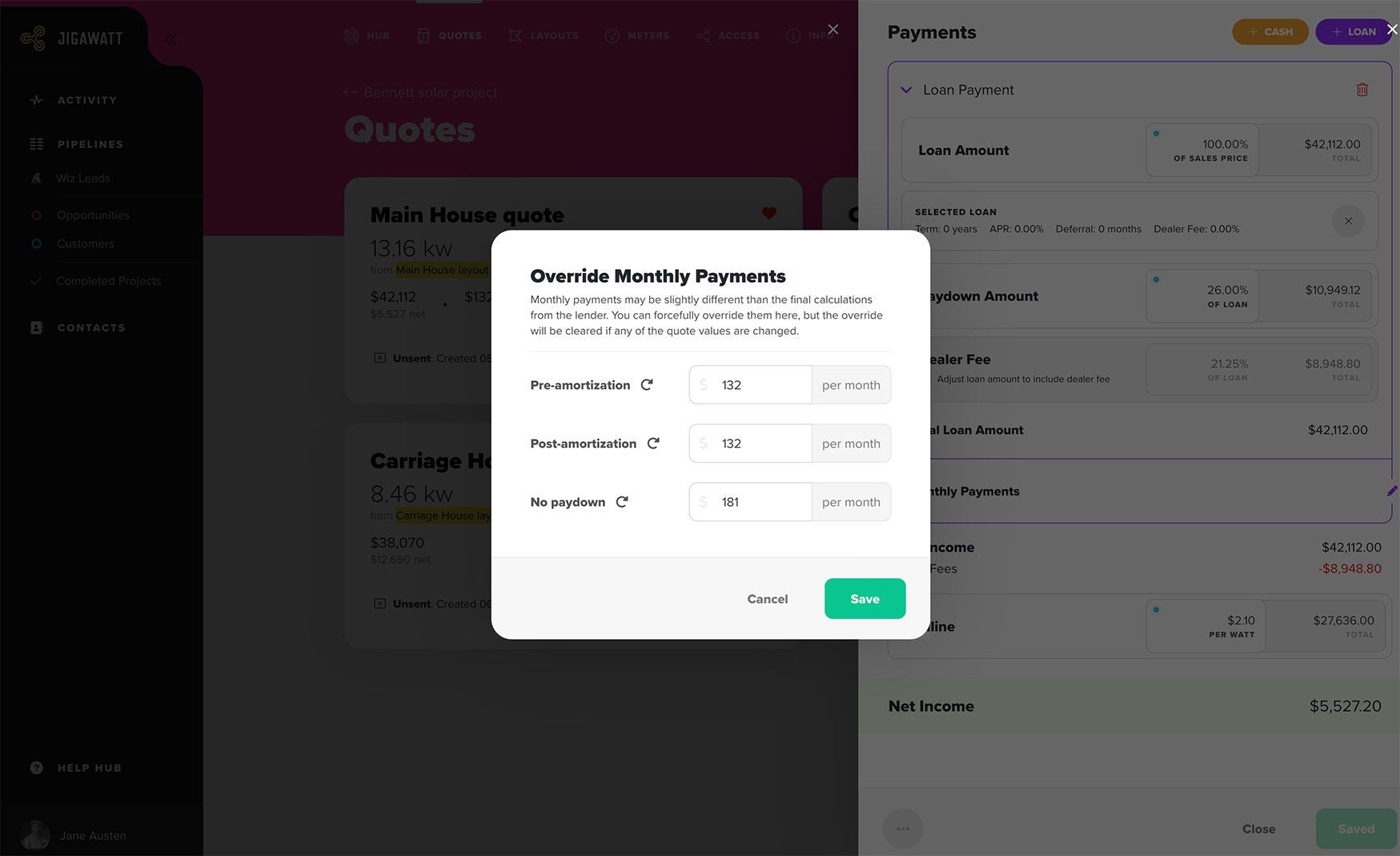

Payment adjustments

Most lenders require your proposal to reflect the exact loan payment as the lender contract. If you're using a non-integrated lender with your Jigawatt Fusion proposal, being just a few dollars off can be very inconvenient! Jigawatt Fusion lets you adjust the loan payments as they're presented on the proposal. Simply click on the payment rate and enter new values as a substitute. Changing loan parameters or recalculating will wipe the override.